Table of Contents

01 All You Need To Know About COVID-19

02 Mantra Unveils IoIX @ IISA 2020 in Mumbai

03 Is Insurance Shaping Behavior & Society?

04 The State of AI In Insurance 2020 Report

05 Here’s how you take ICR Accuracy to the Next level

Latest

ALL YOU NEED TO KNOW ABOUT COVID-19

Amidst the ongoing global crisis, coronavirus is probably all you’re reading about right now. To help you understand the impact of what is to come, we have compiled a list of relevant links that will help you understand the spread and its impact, preventive measures to adopt, myths that have been debunked about the virus, etc.

- 1mg has prepared a concise ebook dispelling myths and breaking down what exactly is the COVID-19/coronavirus, and how it can affect us. You can download the ebook here.

- Microsoft has launched a real-time updated COVID-19 tracker. You can view the live dashboard here.

- Global Web Index has provided some preliminary findings on the impact to customers. You can read more about it here.

Latest

MANTRA UNVEILS IoIX @ IISA 2020 IN MUMBAI

The recently concluded India Insurance Summit & Awards held in Mumbai, brought together CXOs and representatives from all the major insurance carriers within India. Industry experts were invited to participate in panel discussions on topics like: Digital Insurance 2.0, AI & Blockchain, Data security, The next disruption in health insurance, among others.

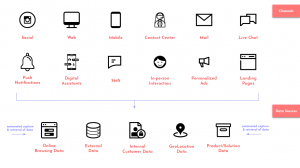

Mantra Labs CEO, Parag Sharma introduced a new sensory disruption for Insurance CX with the unveiling of the Internet of Intelligent Experiences (IoIX). Mantra Labs is using data, analytics and deep domain expertise to bridge the gaps in the customer journey for insurers to maximize existing points of interaction or create new touchpoints by leveraging our sensory perceptions, to make the process more seamless and intuitive.

To learn more about IoIX, Watch the video here.

Opinion

IS INSURANCE SHAPING BEHAVIORS & SOCIETY?

Insurers have always relied on third-party data brokers and historical claims data to make pricing and delivery decisions. InsurTechs on the other hand, are combining new data-collection technologies to provide direct access to more timely, higher resolution, higher volume, and more robust data sets to make pricing and delivery decisions.

Among others, there are three increasingly common sources of data namely wearables, drones and automobile telematics that can capture higher resolution data in real-time. These data sources are also rapidly maturing examples of this transition and are becoming an important component of health, auto-related insurance.

In health, as an incentive to promote healthy behaviors, policyholders earn rewards for reaching health goals. Startups such as FitSense (fitness) and Beam (dental) are, alternatively, utilizing sensors to stream data directly to partner insurers.

As consumers understand their risks in real time, and those risks are more directly linked to their expenditure through InsurTech, we are seeing a new wave of insurance products shifting behavior. For example, HealthIQ asks their customers “Want a lower premium? Show that you can run an eight-minute mile and 10 miles a week”.

New Product Innovations from Insurance-Insurtech Partnerships

Read our latest blog here.

Opinion

THE STATE OF AI IN INSURANCE, 2020 REPORT

Mantra Labs has published a report and brief outlook on the State of AI in Insurance within the Indian Landscape for 2020. According to the findings of the survey, predictive analytics has risen to the top of insurer priorities for the coming decade. As investments in Artificial Intelligence continues to rise, Insurance analytics has the potential to improve several functions of the value chain including underwriting, risk appraisal, claims, pricing and marketing.

Omni-Channel Fulfilment with AI

Download the latest report here.

Insights

HERE’S HOW YOU TAKE ICR ACCURACY TO THE NEXT LEVEL

The industry average for ICR (Intelligent Character Recognition) accuracy at the character level is about 70% and it will drop significantly if measured at the word level which is what matters at the end. Such automation may allow for reducing the number of data entry personnel but with such a low level of accuracy there will be a need for increased quality check resources, which are often more expensive than data entry resources hence diluting the cost-benefit of automation. Moreover, since the quality check is a slower process than data entry, this kind of automation doesn’t even address the speed problem.

Our Proprietary AI platform for Insurance, FlowMagic, is a collection of individual building blocks that can be stringed together to replicate an insurer’s workflow or organization-wide process. These building blocks are applications that are programmed for a highly specific function like document parsing.

The Document Parser solution in FlowMagic provides an intuitive user interface for meaningfully extracting data.

- The standard form being annotated can be any number of pages.

- The system can read handwritten as well as printed forms.

- The system corrects for minor misalignments during scanning of documents or documents scanned in the wrong orientation.

- The system has inbuilt dictionaries for various contexts such as Name, Cities, States, Countries, PAN, Profession, Marital Status, Relationship, Amount, Car Make, Date, Gender.

- The various data types supported by the system are alphabets, numeric, alphanumeric, checkboxes and special characters.

- The system corrects user errors or scanning issues by performing data type and dictionary checks (see examples below).

- The system checks for mandatory fields to make sure the form is completely filled.

Although declining, the Insurance field is still paper-intensive. Insurers are shifting towards AI-powered engines to replace unnecessary manned effort behind redundant operational tasks. These systems can bring about at least a 70% reduction in manual processing and 30% improvement in cost-efficiencies throughout the value chain. FlowMagic is helping insurers improve the accuracy and speed of document digitization/Intelligent Character Recognition for high volume routine tasks.

Read our latest blog here.

Business cognizance for the new-age digital insurers