Table of Contents

01 The Insurance Monthly Roundup

02 Decoding India’s Digital Health Ecosystem

03 The Implications of Carrier licenses for InsurTechs

04 Consumer Research: ‘Mobile’ is not the same as Digital

05 Five Most Effective Tools/Techniques to Empower Service Reps/ Agents

The Insurance Monthly Roundup

A quick roundup of the month’s insurance and insurtech news.

(India)

- Policybazaar, the Indian Insurance Aggregator plans IPO listing in 2021 at a valuation of $3.5 billion.

- Amazon, in partnership with Acko General Insurance has launched car and bike insurance. The company also plans to offer life, health and general insurance soon.

- WhatsApp announced pilot projects to bring insurance, micro-pension and credit to lower-wage workers over the next year-and-a-half. (Global Fintech Fest 2020)

(Global)

- Duck Creek, an Enterprise P&C Insurance Software company has registered for IPO at $200 million valuation.

- Hippo Insurance plans for IPO in 2021 after raising $150 million.

- Lemonade and Nexsys Technologies partner to simplify homeowners insurance verification process.

- Thoma Bravo acquires Majesco InsurTech for $594 million.

The State of AI Chatbots in Insurance

Read report

Decoding India’s Digital Health Ecosystem

The COVID-19 crisis is a tipping point in the adoption of digital health based technology. Prolonged lockdowns have created an urgency for hospitals to opt for virtual healthcare models, remote-care solutions and wearable devices in order to serve patients in a COVID-19 world. So far, digital was confined to finding doctors’ availability and booking appointments (e.g. Practo, iCliniq). Today, many major healthcare organizations including Apollo, Fortis and Manipal Hospitals have launched digital health applications for online consultations beyond general inquiries.

Digital health can enable people to self-manage their situations effectively. In general, digital health covers technologies, smart devices, computational analysis, medical reports management to help patients and healthcare professionals manage health and promote wellbeing.

Source: Invest India Report

The Future of Digital Healthcare in India

- According to the Future Health Index (FHI) report, 76% of healthcare professionals in India are already using Digital Health Records (DBRs) in their practise.

- 87% of Indians who have access to their digital health records – want their healthcare professionals to have access as well.

- The NHS digital framework is aiming for Digital Health Records for all citizens by 2022 to leverage the full benefits of telemedicine and e-health for all Indian citizens.

A Digital 360° Patient Management App

Read Case Study

The Implications of Carrier Licenses for InsurTechs

InsurTechs are making a move towards becoming full-stack insurance carriers in order to launch their own products easily. Indian InsurTechs like Acko, GoDigit and Navi General Insurance have already acquired carrier licenses and globally, InsurTechs like Pie Insurance, Hippo are following the same league. Here are the possible implications:

- With the insurance license, InsurTechs will be able to compete directly with incumbents.

- So far, the majority of profits from underwriting remains with licensed insurers or reinsurers. InsurTechs used to get only fixed commissions against every policy sold. With this move, InsurTechs would be able to enjoy underwriting profits.

- InsurTechs will have more control over their products and operations.

- Risk management and government regulations can be a challenge for InsurTechs when they plan to venture into the carrier role.

Hidden InsurTech Problems

Read blog

Consumer Research: Mobile is not the same as digital

According to a recent Salesforce worldwide study, 6700 insurance customers ranked factors that influenced that were important to their decision making process before buying.

| 1 | Knowledgeable Sales people |

| 2 | Quick & Easy Checkout |

| 3 | Product Comparison Tools |

| 4 | Seamless Transitions between channels |

| 5 | Mobile applications |

| 6 | Product recommendations (that match buying habits) |

The research also provided evidence of disparities between what insurance executives consider important vs. what consumers and business buyers value when buying insurance products and services.

Source: Salesforce Study

Key Insights:

- The most striking gap involves knowledgeable sales people – ranked first by consumers and business buyers but last by executives. A relatively low ranking suggests that insurance leaders may be underinvesting in tools to empower their agents, especially when it means appearing ‘knowledgeable’ in front of consumers and business buyers.

- ‘Mobile apps’ is fifth on the consumers list but at the top of the executive’s list. For consumers, this is likely due to poor perception of mobile experience within insurance. Mobile is only considered as an option in the buying process. For executives, the high priority placed on mobile is likely attributed to the confusion between mobile and digital enablement. Mobile is a channel, and is not the same as digital. Digital customer experience involves the front, middle and back office.

- Product recommendation is ranked last by consumers, while much higher for executives. This is likely because consumers feel that this ‘digital retailer-like’ feature is assumed to be a standard part of the buying process.

Living up to the Customer is the nouveau!

Read blog

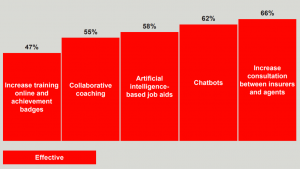

Five Effective Tools/Techniques to Empower Service Reps/Agents

Insurance leaders rank, traditional factors like price, product features and superior claims service no longer as strong differentiators. Instead, outward facing capabilities especially with regard to agents and brokers are seen as the new basis of competition. In fact, a differentiated customer service experience, enhanced agent/advisor productivity and better distribution management have the potential for highest value creation.

A mix of ‘technology and training’ is seen as the best approach to better equip service reps and agents, according to a recent Deloitte Digital report.

Source: Deloitte Digital report

Quick Insights:

- Due to the complex nature of most insurance products, increasing consultation between insurers and agents can lower the likelihood of mis-selling.

- Agents and executives are both enthusiastic about chatbots usage within the selling process. They are seen as the best tool to improve the agent’s knowledge base.

- Use of predictive modeling and machine learning to deliver a personalised experience and match buyer’s preferences with their habits is a prime use case of AI-based job aids.

- Collaborative coaching, online training and achievement badges are primarily important for improving employee development & productivity, and not just as a technology play.

Why automate agent onboarding

Read blog

Business cognizance for the new-age digital insurers