While every organization manages their ‘sales funnel’ differently, they must all address the arduous task of handling leads competently. In the Insurance business, generating quality leads is proving to be a tough assignment for older agents, as their collective numbers dwindle down — as more business is being transacted online, creating a complex web of lead data to consolidate, than ever before.

For an insurer or broker, unearthing excellent leads is only half the battle won — converting the semi-interested, prospective buyer to ‘loyal avengers’ of your brand is the true test. Without an adequate analysis of the lead data, insurance firms are more likely to let valuable customers slip through unnoticed. Infact, 80% of marketing leads are either lost or discarded because of poor lead management; while 80% of leads passed onto the sales agents are unqualified — according to research on lead management, surveyed among B2B organizations in 2019.

Documenting a prospect’s complete story of interactions & experiences with your organization, delivers timely insights into exactly how and when a prospect was converted from an ordinary ‘lead’ to a ‘customer’. Most of the sales follow-up process including managing leads, prospecting new business and dispatching service to existing clients — is time consuming and for the most part, manually done. On the other hand, outside competition via other brokers and organizations offering closely matched services and products are most likely to capitalize on the mistakes you have failed to identify early — which brings us to — What is it about your business that will capture a prospect’s attention long enough to close a sale, build quality relationships, and encourage referrals? For an effort of this magnitude, the journey begins with a strong lead management framework.

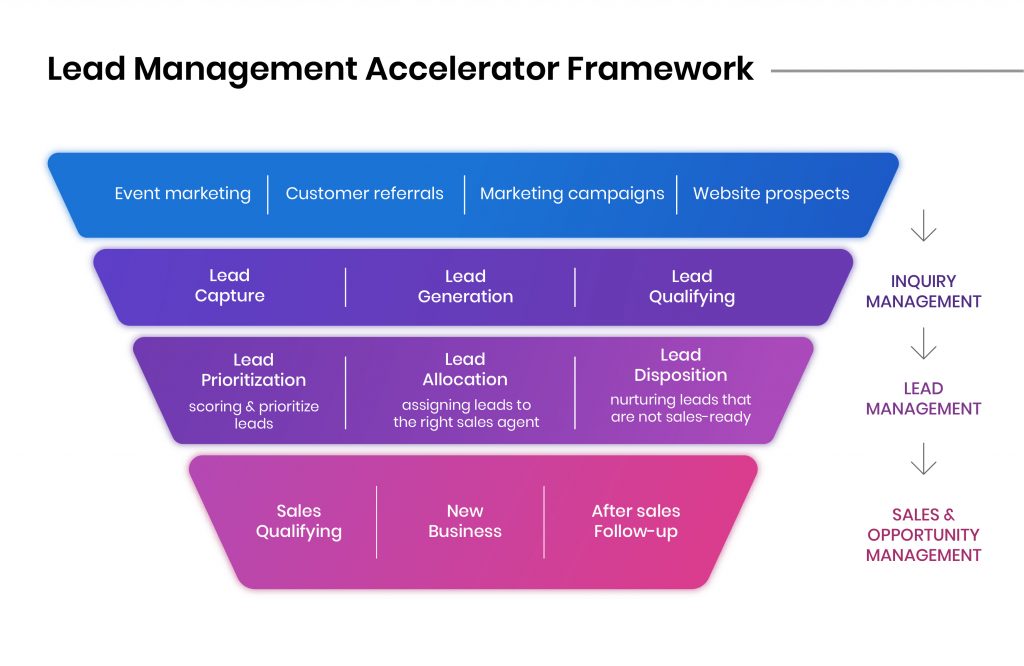

The transition for qualified ‘leads’ as it evolves through the organization’s marketing and sales pipeline, eventually passes through several phases or ‘lead stages’.

Lead Management Accelerator Framework

Here’s why Insurance needs an Accelerated Solution —

Lead Prioritization

- Clustering of leads based on assorted attributes — profile, source, income, demographics etc.

- More targeted and focused approach on managing prospects.

- Helps improve the quality of leads to the caller/sales team.

Lead Allocation

- Profile analysis of callers to identify their strengths and allocate leads accordingly.

- Enhanced and optimized Lead Conversion thereby creating profitability.

Lead Disposition

- For time effectiveness quick, detailed & one-stop disposition.

- Seamless integration with insurance core platform allows quick access of quotes and payment service.

- Allow effective communication by means of various integrations like e-mail, SMS, dialers etc.

- Various features like document repository, call scheduling, lead journey chart helps callers handle lead dispositions aptly.

The implementation of a strong framework makes a dedicated LMS solution for the insurance industry not only desirable, but strategically important for the industry.

From creating qualified opportunities and ultimately satisfied customers — Lead management is the backbone of a successful sales operation. The sales process should integrate with lead management seamlessly, which is why an automated LMS with customizable workflows harnessing Artificial Intelligence/Machine Learning is a complete solution. By automating the sales process we can ensure calls, demos, follow ups and meetings — even potential revenue — isn’t slipping through the sales pipeline undetected.

To know more about how Insurers can create workflow specific LMS solutions, get in touch with us — hello@mantralabsglobal.com

Knowledge thats worth delivered in your inbox