Digital transformation has gone from talk to action, with a momentum that shows no signs of slowing down. As cognitive capabilities have penetrated process, people, technology, things, augmented intelligence and decision making; the cognitive approach to insurance business is no longer considered a back-office ‘efficiency play’.

A cognitive computing system replicates human intelligence and comes up with solutions for largely ambiguous and complex situations. Implementing this cognitive capability in Insurance enhances customer insights and deduce customer feel through interaction insights, sentiments and connectedness.

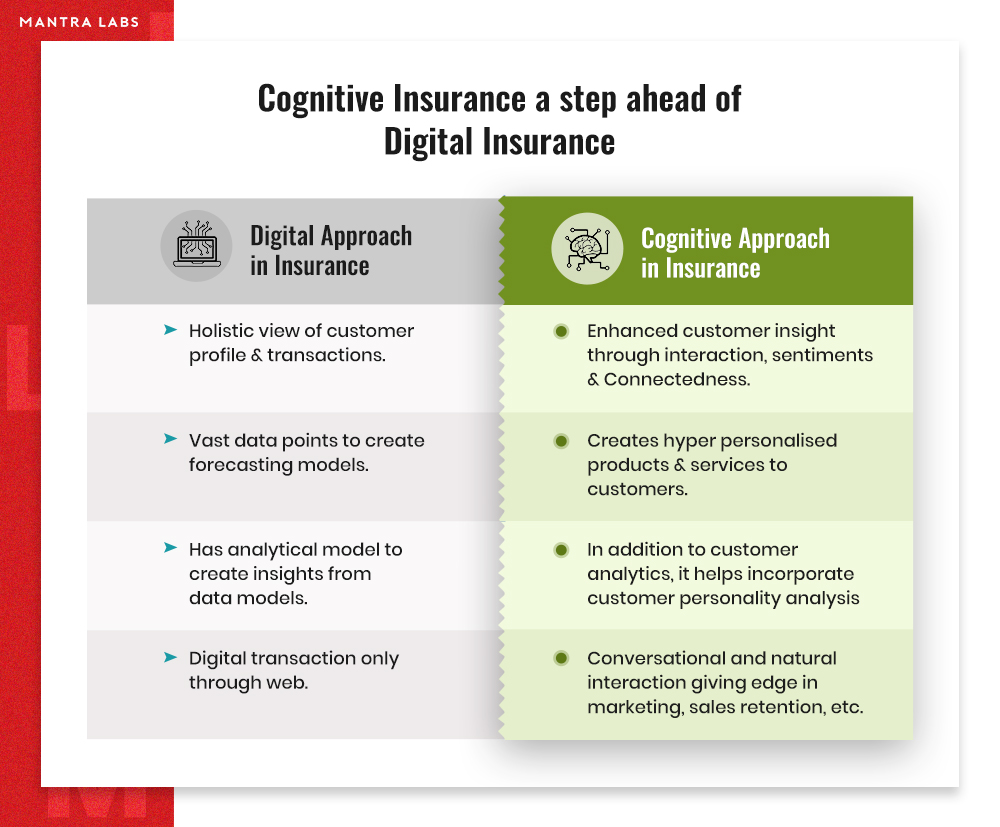

In Insurance, where companies are constantly tweaking business models to improve profitability, the digital approach to insurance is falling short of industry expectations. The ‘Cognitive’ approach is a step ahead of the ‘Digital ‘approach to insurance, and Data is the key ingredient to going cognitive.

The word cognitive is often used interchangeably with the term Artificial Intelligence. However, there are subtle differences between the two, in terms of their purpose and application. Cognitive computing is a process used to describe AI systems that aim at implementing human thought processes such as real-time analysis of the environment, context and intent analysis; and the ability to solve problems. Where AI relies on algorithms to solve a problem, cognitive computing systems have higher goals of creating algorithms that mimic the human brain’s reasoning process to solve a number of problems with changing data and problems.

The purpose of going cognitive in insurance was created solely with the purpose of reducing human effort and refining the existing process across various insurance verticals.

Examples of cognitive insurance use cases.

- Traveller’s Insurance Group had sent a fleet of 65 drone surveillance operating-agents to Houston in order to assess the damage from Hurricane Harvey -the costliest tropical cyclone in recorded history

- USAA had rolled out an Intelligent Personal Assistant, using Amazon Alexa and Clinc that has insurance industry-specific deep vocabulary and knowledge, that goes beyond the capabilities of traditional chatbots or digital solutions.

- Liberty Mutual introduced a new app to help drivers involved in car accidents, to quickly assess the damage to their car in real-time using a smartphone camera. The app provides damage-specific repair cost estimates.

- AXA Insurance implemented a Google Tensor Flow-based application by using deep analysis of customer profiles. The application can optimize pricing by predicting traffic accidents with nearly 78% accuracy.

- Fokoku Mutual, a large Japanese Insurance company, has replaced it’s 34 strong claims assessment workforce with an implementation of IBM Watson Explorer AI solution. The solution can analyze and interpret claim data including unstructured text, images, audio and video to decide policy payouts.

In the past, insurance industry professionals made decisions based on experiences and historical data. A cognitive approach, to insurance business solutions, is at the helm of a new wave bringing innovation and transformation to insurance. These cognitive capabilities enable insurers to make strategic decisions based on a set of data which continuously updates in real-time, thereby leveraging AI to bring automated efficiency to insurers while delivering the best possible experience to the insured user.

References:

https://www.mantralabsglobal.com/blogs/cognitive-automation-and-its-importance/

Use cases:

https://www.linkedin.com/pulse/cognitive-use-cases-insurance-sushil-pramanick-fca-pmp/

https://searchenterpriseai.techtarget.com/definition/cognitive-computing

Knowledge thats worth delivered in your inbox