Table of Contents

01 The State of CX In Insurance, 2022 Report

02 The Insurance Monthly Roundup

03 LIC IPO: Key Insights

04 Latest CX Trends in Insurance

05 Insuring NFTs- An absolute necessity?

The State of CX in Insurance, 2022 Report

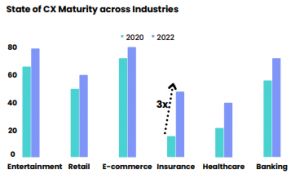

Mantra Labs has published a report and brief outlook on the State of CX in Insurance for 2022. According to the findings, 58% of insurers agreed that they are in the Emerging stage in the CX maturity graph. Insurance industry is at the cusp of digital transformation where a volatile shift in the consumer mindset is compelling insurance organizations to assess their existing business strategy and accelerate the digitalization of all the touchpoints. However, this online business model brings some innate challenges for the companies: deciphering the dynamic customer expectations and bridging the existing experience gap.

In order to address these concerns in both business and consumer-facing worlds, insurers are comprehensively moving from experimental to experiential stage and investing in Customer Experience strategies.

Digital customers today want to buy an experience rather than just a product or a service. The pandemic has forced a massive shift towards CX maturity. Insurance outperformed other industries by 15 times when it comes to the uptick in CX maturity. Of course, a low base effect has been a major factor for this hypergrowth but recent investments in this space will only lead to near exponential escalation and organizations need to align their CX strategy with their core business strategy to ride this wave.

State of CX In Insurance

Read the full report.

The Insurance Monthly Roundup

A quick roundup of the month’s insurance and insurtech news.

(India)

- Tata AIA teamed up with Common Services Centers (CSC) to boost life insurance penetration in rural India. Customers will be offered the Tata AIA Life POS Smart Income Plus plan, which provides the dual advantage of a life cover combined with savings.

- One Moto India has partnered with Royal Sundaram General Insurance to provide its electric car customers an add-on cover-depreciation waiver that allows them to make a full claim without deduction, and also competitive pricing and a cashless facility for claims at One Moto outlets.

- HDFC Ergo has unveiled ‘Pay as you Drive’ plan, which is a distance-based insurance solution that enables customers to pay premiums based on real vehicle usage, lowering premium upfront costs.

- Turtlemint secured $120 million in a Series E round of funding which will be used to expand into other geographies, such as Southeast Asia, extend the leadership team, and strengthen the product line.

- ETAP bagged $1.5 million in the pre-seed investment round. The funds will be used to promote the debut of ETAP’s game-changing app, which allows users to buy insurance in 90 seconds, file claims within 3 minutes, and receive rewards for safe driving.

(Global)

- Global insurtech investment will reach $15.8 billion in 2021, according to Gallagher Re’s Global Insurtech Report.

- FutureProof Technologies acquired $6.5 million, which will be used to establish an MGA entity that will use high-resolution risk selection and pricing to underwrite policies and hire top underwriting, portfolio risk management, and technical expertise.

- Surance.io received $4 million from Tech Mahindra, which acquired 25% equity of the start-up and has the option to invest an additional 20%. This investment will help the InsurTech player expand globally.

- Insoore secured €5.5 million in funding which will be used to develop AI projects in damage detection, engage new talent and expand globally.

- The BeSafe group, based in Italy, raised €1.2 million to support the development of insurance and technology for European tourism, merging insurtech and travel tech.

Conversational Intelligence: The Next Big Thing In Customer Experience

Read our Latest Blog here.

LIC IPO: Key Insights

- The LIC IPO received 96% subscription, with bids for 15.50 crore equity shares versus a 16.2 crore equity share offer size.

- The price range for the IPO is Rs 902-949 per share, with a discount of Rs 60 per share for policyholders and Rs 45 per share for retail investors and LIC employees.

- Despite losing market share over the years, the Life Insurance Corporation of India (LIC) continues to dominate the insurance industry. Even though its 8% premium increase was lower than the industry’s 13% and private sector companies’ 23%, it still has a 63% share in first-year premiums and a 75% share in the number of policies sold.

- Only 2% of the shares set aside for institutional buyers have been ordered by overseas institutional funds.

- While sovereign funds from Norway and Singapore participated in the anchor portion of the IPO, the majority of the shares went to domestic mutual funds.

State of Metaverse-based Ecosystems in Fin-Tech

Read the full blog.

Latest CX Trends In Insurance

Here are the top 2 Customer Experience Trends in Insurance:

- Predictive Experience

Early movers in predictive analytics have transformed the art and science of customer experience and the way insurers evaluate customer expectations in their line of business. Using predictive consumer insights, insurers are able to connect more closely with the customers, anticipate behaviors and identify CX-related problems in real-time. Implementing solutions that can forecast customer expectations based on their historical pattern without the consumer articulating their need explicitly can directly improve customer satisfaction and boost revenue per customer. Likewise, predictive insight can amplify agent experience by enabling them in meeting consumer needs. US-based Farmers Insurance has introduced a predictive risk-scoring model that assesses wildfire risk to properties using high-resolution imagery and weather data. The data generated can be used to boost the number of residences eligible for insurance.

- Omnichannel Engagement:

The new-age customers want multiple channel options that are easily accessible to choose from while buying a product. Today, brands are actively leveraging different platforms to maximize their visibility and engage with their potential customers.

According to a Capgemini report, more than 50% of the customers prefer to use three or more channels to purchase insurance. Now, they want seamless customer support across every channel, that can be resumed even if the conversation is disrupted at any point of time. Conversational AI-driven platforms can capture the sentiment of the users and gather customer intelligence in real-time that helps continue the same conversation across multiple channels. This enables insurers to keep the customers engaged and enhance the overall digital insurance experience. For example, Hitee- a conversational AI platform built by Mantra Labs can solve customer issues proactively and optimize engagement journeys.

Solana: The next in Blockchain

Read our blog here.

Insuring NFTs -An absolute necessity?

Non-Fungible Tokens can’t be traded interchangeably due to their unique numbers and codes. Because NFTs are so expensive, hackers and scammers have been actively eyeing the NFT world for their monetary gains. For buyers, digital security has become a serious concern.

Insuring digital assets is an absolute necessity now, so the question here is whether NFTs can also be insured? The answer is, yes. Buyers may get compensated for fraudulent activities in the following situations:

a)In case, the private key is lost by the owner.

–When an NFT is created, it has dual keys: private and public. The blockchain ledger maintains the public key whereas the private key acts as proof of ownership.

b)When scammers sell replicas and fake digital assets.

c)Damages caused by intervention on the blockchain.

Here are some of the recent additions in the NFT Insurance space:

- Coincover provides corporate and consumer protection for NFTs through an insurance-backed solution. The company protects its partners’ wallets and the NFTs they possess from hacking, phishing, and other illegal activity, while also providing an insurance-backed guarantee in the event that something goes wrong. This is in addition to their disaster recovery service, which is a backup key recovery service that allows NFTs to be recovered in the event of lost passwords.

- Due to increased demand from NFT holders seeking security against hacking and theft, Hong Kong-based virtual insurer OneDegree has teamed up with Munich Re to expand its OneInfinity cryptocurrency insurance service to clients such as firms dealing with NFTs.

- Recently, Amulet has secured $6m in its first funding round to provide insurance coverage in the Web 3.0 world which includes NFTs as well. The first Rust-based decentralized finance (DeFi) insurance protocol will utilize Solana’s PoS network to provide insurance service and stable returns. Using its unique Protocol Controlled Underwriting and Future Yield Backed Claim mechanisms, the firm will reduce the risk for underwriting capital providers.

The loss of a digital asset may have serious repercussions not just for the owner, but also for the entire ecosystem, as NFT may lose its value if it is not secured. Open Sea – the world’s largest NFT marketplace lost $1.7 million worth of NFTs due to a phishing attack. A Bengaluru-based caricature artist found that one of his artworks was listed on Open Sea, without his knowledge. The media and insurance companies have been paying close attention to massive losses like these. NFT owners and creators will seek insurance to protect them as they become more aware of the risks involved in owning digital assets. With pioneers such as Coincover and Amulet leading the way, it’d be intriguing to see how the development unfolds in the NFT insurance space.

Can NFTs be insured, and who carries the risk?

Read the full blog, here.

Business cognizance for the new-age digital insurers