In this unprecedented time, the announcement of the Covid Standard Health Policy by IRDAI has unlocked dual benefits. One, people who don’t have comprehensive health cover, will now have insurance covered against Covid. Two, most of the processes including distribution and claims have a digital process, which is simplifying operations for Insurers.

All health and life Insurers will start offering Corona Kavach and Corona Rakshak policies by July 10, 2020. The premiums for both the products are standard PAN India.

Corona Kavach is a standard indemnity-based policy that will cover the cost of treatment of any comorbid conditions, including pre-existing conditions, along with the treatment for the coronavirus infection.

Corona Rakshak is a standard benefit-based policy, which hands out a pre-agreed lump-sum upon diagnosis. This can be used as a supplement for additional funds during a pre-insured health incident.

The main aim of these policies is to help people with better health insurance coverage in these unprecedented times of pandemic. To simplify operations, most aspects of these policies will be handled digitally. “Trusting digital” has been a serious concern for customers and a major roadblock in the Insurers’ digital transformation strategy. But this move by the Government is opening new avenues for the adoption of digital among Insurance customers.

Let’s discuss the business implications and new opportunities with the introduction of Corona Kavach and Corona Rakshak policies.

New Challenges with the Introduction of “Corona Kavach”

While customer-centricity is the main theme of announcing standard Covid policies, there lies some inherent challenges to implementation.

For instance, claims management will be an important aspect of these policies, especially when Insurers can foresee the voluminous requests. In general, nearly 80% of claims filed are manually reviewed by adjusters.

Normally, health insurance claims settlement is a document-heavy process where the claimant has to submit a number of documents like hospital discharge certificate, medical bills, prescriptions and pharmacy cash memos, FIR (for accident cases), to name some. There isn’t a standard format for all of these documents and Insurers have to manually review each of them which is time-consuming and delays the settlement process.

Insurers can leverage technologies like ICR (Intelligent Character Recognition) with handwritten document processing capabilities to improve speed & accuracy and reduce manual document processing efforts.

For example, Mantra Labs’ ICR can extract data from a 5-page handwritten Insurance form in under 30 seconds with over 90% character level accuracy in interpreting data.

Related: Pushing the Envelope on ICR Accuracy in Hand-written Forms

However, the influx in the number of claims applications will require a robust system infrastructure that can handle thousands of claims without lag.

Another foreseen problem will be handling the sudden increase in customer queries. Normally, Insurers rely on call-centers for handling customer queries. However, in this difficult time, when most of the staff is working remotely, it is difficult for Insurers to coordinate and scale. For the success of this scheme, Insurers need to focus on reducing the pressure on customer support centers through automation solutions like chatbots. Insurance chatbots have been found to reduce human intervention for routine queries by 10x.

New Opportunities for Insurers amidst Covid-19

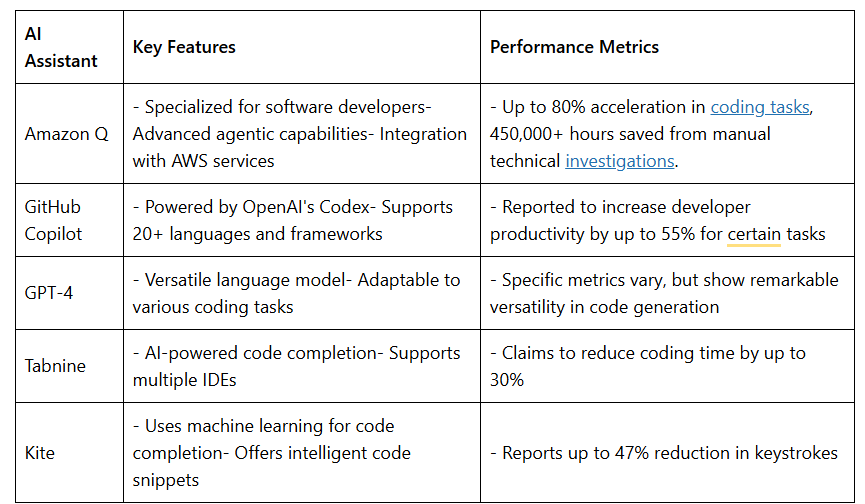

Covid-19 has accelerated the adoption of digital as well as increased affinity towards buying insurance. According to a survey conducted by Swiss Re, Indian consumers are seeking insurance driven by financial and mental health concerns.

| China | India | Japan | Market Avg* | |

|---|---|---|---|---|

| Searched for new policies | 73% | 62% | 13% | 28% |

| Bought a new policy | 56% | 28% | 7% | 15% |

| Made a claim (those who hold a policy) | 23% | 25% | 5% | 11% |

1. Mark Presence in Digital Insurance Marketplaces & Expand Portfolio

These policies aim to cater to people who don’t have a holistic health insurance policy. Given the continuously increasing cases of Covid and reliance on private medical facilities and the undetermined cost of treatment, people are inclined towards buying insurance policies to cover basic treatment costs.

Apart from benefiting individuals and health insurers, this move by the Government can also improve the market for life and non-life Insurers. This is also a great opportunity for Insurers to reach out to prospects in rural areas.

IRDAI has approved all possible distribution channels (physical and digital) including Micro Insurance Agents, Point of sale persons and Common Public Service Centers.

With no restriction on the distribution channels, Insurers have an opportunity to experiment online selling on existing popular marketplaces like PolicyBazaar, Gramcover, BankBazaar and PayTM.

2. Opportunity to Up-sell/cross-sell

“Insurance is not bought but sold” is the bitter fact. Making customers invest in a product that they might need in the future is somewhat hard to sell.

The Covid situation has made people aware of the benefits of insurance in mitigating their financial burden. With more customers, there’s a better chance to up-sell and cross-sell insurance products.

3. Awareness for Micro Insurance Products in India

Indians are accustomed to comprehensive insurance policies and prefer buying policies through insurance agents. Accelerating the change in buyer preferences, Covid Kavach opens opportunities for micro and usage-based insurance products.

Instead of comprehensive insurance policies, Microinsurance products are cost-effective and address the immediate need of customers. Small investments are comparatively easier and this opens the market for microinsurance products in the low and medium-income groups.

4. Digital Policy Documents

Earlier, as per IRDAI norms, Insurers were required to provide policy documents to customers in a physical form.

However, to reduce operational costs, IRDAI has allowed Insurers to issue the policy contract of Corona Kavach Policy in electronic/digital format through email/web link. This will not only help Insurers reduce the cost of operations but also encourage customers to trust duly signed digital documents.

Leveraging the Opportunity

When it comes to scalability, digital is the solution. Although every Insurer has a digital presence, not everyone has deployed automation for their core operations.

For example, most of the queries during this time will be regarding policy coverage, tenure, claims, etc. Self-service chatbots can help customers with immediate response and at the same time automate the claims filing process, policy renewal, raise tickets, and more. Moreover, NLP-based vernacular chatbots can converse with people in their local regional languages.

Related: Mantra Labs launches Multilingual AI chatbot with Video Calling for SMEs

The next step in the preparation for a digital future involves leveraging technologies like Artificial Intelligence. AI can help Insures to precisely understand different personas, policy preferences and customer journeys. It can help Insurance adjusters, claims managers, and other stakeholders with the knowledge about claimants and their current situation, hence delivering a more empathetic experience.

Related: How can Artificial Intelligence settle Insurance Claims in five minutes?

We build AI-First Solutions for the new age Digital Insurer across the entire Insurance Lifecycle. Please feel free to reach out to us for your specific requirements at hello@mantralabsglobal.com.

Knowledge thats worth delivered in your inbox