Across the Insurance expansile, a special fraction within the industry is notable for its embrace of new technologies ahead of others. For an industry that notoriously keeps a straggling pace behind its banking and financial peers, Reinsurance has conventionally demonstrated a greater proclivity for future-proofing itself. In fact, they were one of the first to adopt cat-modelling techniques in the early ’90s to predict and assess risk. This makes perfect sense too — ‘Insurance for insurers’ or reinsurance is the business of risk evaluation of the highest grade — which means there are hundreds of billions of dollars more at stake.

Front-line insurers typically practice transferring some amount of their risk portfolio to reduce the likelihood of paying enormous claims in the event of unforeseen catastrophe losses. For most regions of the World — wind and water damage through thunderstorms, torrential rains, and snowmelt caused the highest losses in 2019.

In the first half of 2019 itself, global economic losses from natural catastrophes and man-made disasters totalled $44 billion, according to Swiss Re Institute’s sigma estimates. $25 billion of that total was covered by reinsurers. Without the aid of reinsurance absorbing most of that risk and spreading it out, insurance companies would have had to fold. This is how reinsurance protects front-line insurers from unforeseen events in the first place.

Yet, protection gaps, especially in emerging economies still trails behind. Only about 42 per cent of the global economic losses were insured as several large-scale disaster events, such as Cyclone Idai in southern Africa and Cyclone Fani in India, occurred in areas with low insurance penetration.

Reinsurance can be an arduous and unpredictable business. To cope with a prolonged soft market, declining market capital and shaky investor confidence — reinsurers have to come up with new models to boost profitability and add value to their clients.

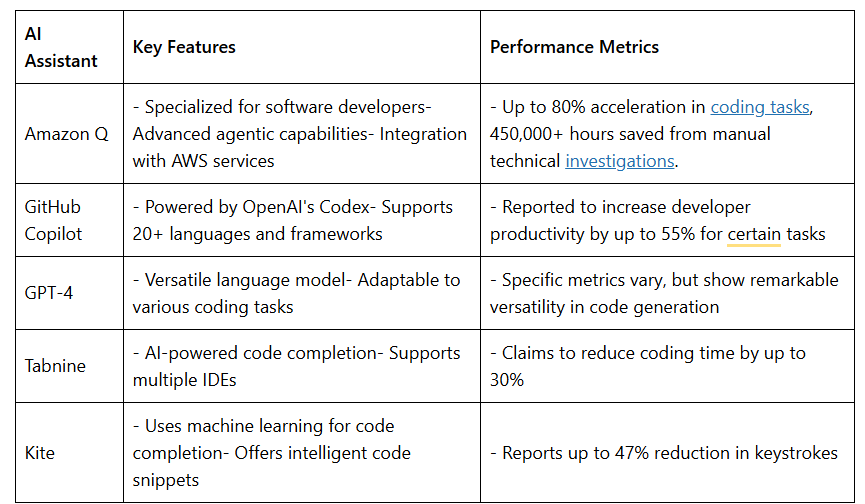

For them, this is where Artificial Intelligence and the sisterhood of data-driven technologies is bringing back their edge.

Source: PwC – AI in Insurance Report

AI Use Cases for Reinsurers

Advanced Catastrophe Risk Modelling

Catastrophic models built on machine learning models trained on real claims data, and ethno- and techno-graphic parameters can decisively improve the authenticity of risk assessments. The models are useful tools for forecasting losses and can predict accurate exposure for clients facing a wide range of natural and man-made risks.

Mining Data for behavioural risks can also inform reinsurers about adjusting and arranging their reinsurance contracts. For example, Tianjin Port explosions of 2015 resulted in losses largely due to risk accumulation — more specifically accumulation of cargo at the port. Static risks like these can be avoided by using sensors to tag and monitor assets in real-time.

RPA-based outcomes for reducing operational risks

RPA coupled with smart data extraction tools can handle a high volume of repetitive human tasks that requires problem-solving aptitude. This is especially useful when manually dealing with data stored in disparate formats. Large reinsurers can streamline critical operations and free employee capacity. Automation can reduce turn-around-times for price/quote setting in reinsurance contracts. Other extended benefits of process automation include: creating single view documentation and tracking, faster reconciliation and account settlement time, simplifying the bordereau and recovery management process, and the technical accounting of premium and claims.

Take customised reinsurance contracts for instance that are typically put together manually. Although these contracts provide better financial risk control, yet due to manual administration and the complex nature of such contracts — the process is prone to errors. By creating a system that can connect to all data sources via a single repository (data lake), the entire process can be automated and streamlined to reduce human-related errors.

Risk identification & Evaluation of emerging risks

Adapting to the risk landscape and identifying new potential risks is central to the functioning of reinsurance firms. For example, if reinsurance companies are not interested in covering Disaster-related insurance risks, then the insurance companies will no longer offer this product to the customer because they don’t have sufficient protection to sell the product.

According to a recent research paper, the reinsurance contract is more valuable when the catastrophe is more severe and the reinsurer’s default risk is lower. Predictive modelling with more granular data can help actuaries build products for dynamic business needs, market risks and concentrations. By projecting potential future costs, losses, profits and claims — reinsurers can dynamically adjust their quoted premiums.

Portfolio Optimization

During each renewal cycle, underwriters and top executives have to figure out: how to improve the performance of their portfolios? To carry this out, they need to quickly assess in near real-time the impact of making changes to these portfolios. Due to the large number of new portfolio combinations that can be created (that run in the hundreds of millions), this task is beyond the reach of pure manual effort.

To effectively run a model like this, machine learning can shorten the decision making time by sampling selective combinations and by running multi-objective, multi-restraint optimization models as opposed to the less popular linear optimization method. Portfolio optimization fueled by advanced data-driven models can reveal hidden value to an underwriting team. Such models can also predict with great accuracy how portfolios will perform in the face of micro or macro changes.

Repetitive and iterative sampling of the possible combinations can be carried out to create a narrowed down set of best solutions from an extremely large pool of portfolio options. This is how the most optimal portfolio that maximizes profits and reduces risk liability, is chosen.

Reinsurance Outlook in India

The size of the Indian non-life market, which is more reinsurance intensive than life, is around $17.7B, of which nearly $4B is given out as reinsurance premium. Insurance products in India are mainly modeled around earthquakes and terrorism, with very few products covering floods. Mass retail sectors such as auto, health and small/medium property businesses are the least reinsurance dependant. As the industry continues to expand in the subcontinent, an AI-backed data-driven approach will prove to be the decisive leverage for reinsurers in the hunt for new opportunities beyond 2020.

Also read – Why InsurTech beyond 2020 will be different

Knowledge thats worth delivered in your inbox